September 18, 2023

Achieving Scale and Profitability as a Dutch Tech Company

“We’re going to start creating content specifically for Community Members to address some of the key challenges you face …what should we write about?”

This topic got more votes than anything else: How To Achieve Scale AND Profitability.

Given the current climate with fundraising drying up, it’s not surprising that many of our Community Members are keen on learning more about this route. Profitable growth is in vogue.

Amongst the 400+ founders that make up our Community, only a handful have achieved both scale and profitability. Case in point, when I asked who in the Community I should talk to about this topic… I got crickets…

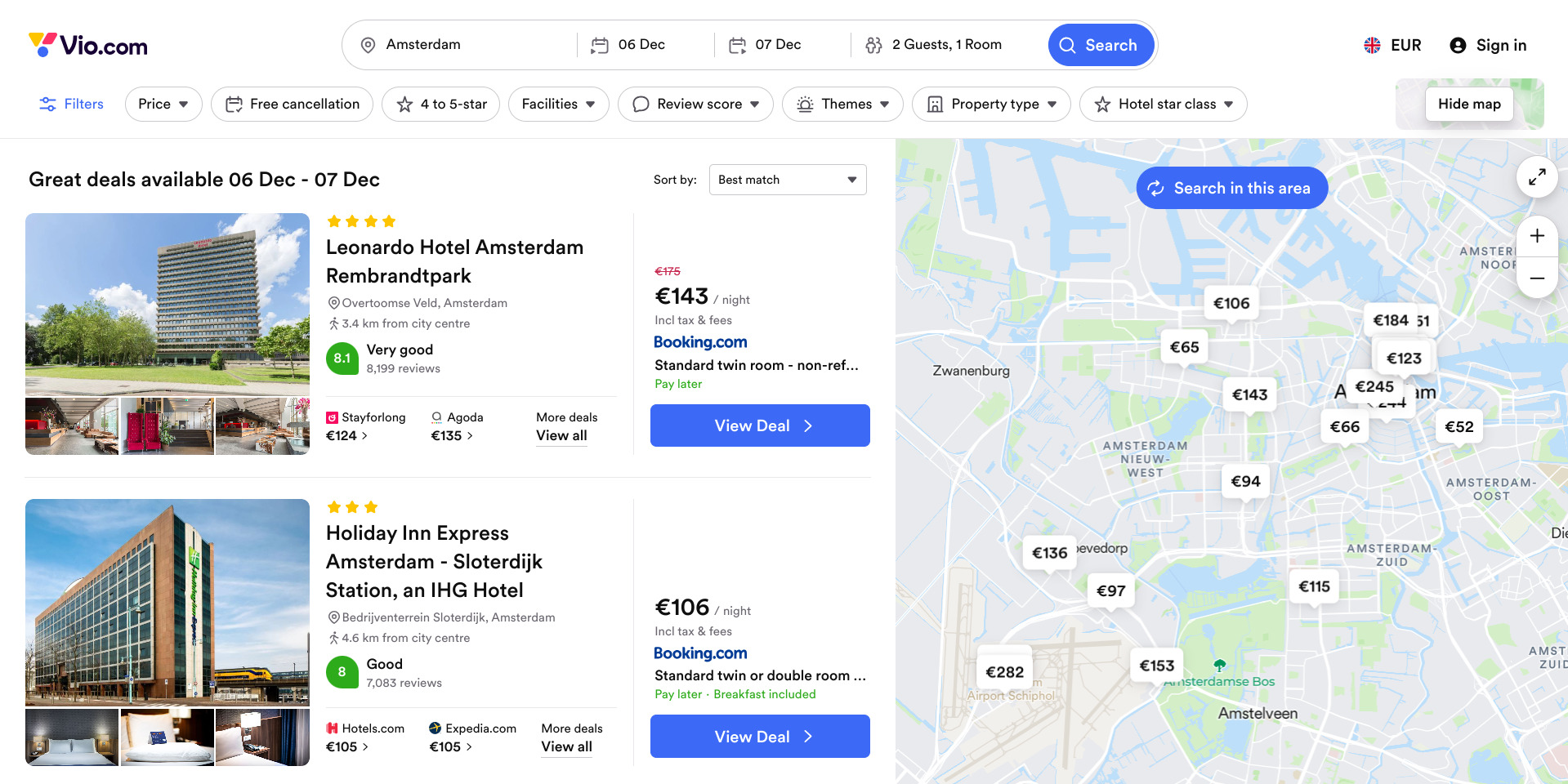

But Oz was the first person I thought of who fit the bill. He’s the founder of Vio.com, a hotel travel aggregator that’s doing over €50 million in revenue per year, profitably. He’s also a member of Techleap’s Founder Advisory Board.

He learned Vio.com’s business from the ground up before building his own product.

In this piece, he shares…

My name is Oz Har Adir, and I’m the founder and CEO of Vio.com (formerly FindHotel). I’m originally from Israel and have lived in the Netherlands for 18 years, having arrived in 2005 as a Bachelor in BA at Erasmus University.

FindHotel BV was founded in 2016, but it evolved out of an affiliate company called Innovative Travel, which I began after graduating in 2010.

Vio.com aims to be the best place to find and book accommodation deals, anywhere in the world.

The company is B2C at its core and this year we expanded to B2C2B via affiliates, which already includes the likes of Skyscanner and TimeOut.

I didn’t think there was any place for travellers to search the entire market and find the best deals, so I built it. I began with flights during university but that failed, so I switched to accommodation.

No. I took out a small family loan when starting and returned it our second year. We considered an equity investment but decided that the time-saving vs the common downsides were not worth it for us.

We were profitable from our second year of operation and have been ever since, with only 2017 and 2020 ending slightly negative. More recently we’ve focused on growing both as profitably and as fast as we can.

It is a transaction model, partially affiliate (we refer visitors to other sites to book) and partially marketplace (where visitors book directly on Vio.com). In both cases we earn a commission when customers complete a stay at their accommodation.

We generate €50M a year in revenue and employ 180 FTE. We’ve been profitable in each of the past 5 years with the exception of 2020, which was slightly negative.

We started out as an affiliate, without our own product. This had many advantages, and helped us develop a profit-mindset from early on:

Starting as an affiliate is a path few scaling companies take, but it’s actually how Booking.com evolved (from Bookings.nl).

If you’re a classic SaaS company you could for example become a distributor, and learn how your market works from the inside, before going all-in on building for your industry.

A more common approach for technical founders is to set-up a services / consulting business to serve as an income generator while building their product. This can help ensure you have enough revenue coming in to pay the bills, while also learning from your clients, which can help build your product. Bynder, which was formed out of the service business Label A, is a good local example of such a spin-out.

Our main metric is ‘contribution margin’. Volume without profits is easy to achieve in a mature market, but profits means you are doing something right. In our case we are looking for millions in contribution margins per year to justify significant investments in anything.

We also pay attention to retention, such as the share of our visitors coming directly, and the probability a booker will search and book again. Retention is a result of exceptional value in the travel niche, and that’s what we strive for.

In travel getting a demand channel to work is key. At first we focused only on PPC (Adwords etc.), assuming the SEO market was too saturated.

Later, we began specialising in price comparison marketing (Metasearch), developing unique tech, pricing, and bidding to become one of the best in the world in this niche.

Nowadays we’re making in-roads in app marketing and via affiliates, complimenting the first two strategies. However, we waited a long time before we added to these, preferring to focus on executing a few channels exceptionally well first.

On the operational side, when our growth stalls, we slow down — largely hiring — and correct course. We don’t increase spending until we see results improve.

Originally, we tried to build as little as possible ourselves, focusing only on what we couldn’t find in the market.

Many startups try to build every aspect of their technology in-house, which requires ample investment, and is often based on limited market feedback. Our approach is to build quickly, gather market feedback, and only build in-house when a system becomes core to us, and something the market cannot offer.

Further, our entire product team is treated as a full-time member from day one, with the occasional use of embedded engineers who are also fully integrated into the team. We also set it up so we can hire them directly after 12 months, which has occurred about a dozen times.

The main issues we’ve faced are:

Most founders are stuck on raising money and the need for speed, because it’s marketed so heavily. But there are advantages to focusing on profitable growth, even if it means growing the upper line more slowly.

As a scaling company you’re always somewhat trading time with money. Fundraising introduces new stakeholders who may push a company towards unreasonable goals, like emphasising speed, rapid hiring, or top-line growth.

When someone like Fabrizio Del Maffeo (also part of our Community) is developing an AI chip for Axelera, securing VC is essential to bring the product to market, due to the cutting-edge nature of his niche. But most software companies are not in this position, and need to challenge the need to take VC at every step. This is true even if you raised early on, as my friend Omer Perchik did with Any.do. They began with an early VC round in the Valley, and later pivoted towards profitable growth. They’re now doing exceptionally well, with 30M active users.

Further, by slowing down and doing things more sustainably, you have more time to learn how to manage, build, and grow, compared to if you are always in run mode.

The main thing with cash flow is that you need to understand your costs, and of course when you’re getting paid. Simple, right?

This means getting a good forecasting model in place to know if you’re on track. We built a very simple Excel sheet, with a stagger chart next to it. From this, we saw we were getting quite good at forecasting.

However, no matter how good your forecasting becomes, you’re always going to get some curveballs. Like many travel companies, COVID was a big one for us — where everything we’d forecast just didn’t work anymore. We would have these huge partners suddenly sitting on their hands and refusing to pay. Instead of 30 days, apparently they would now pay us in 180. Great, thanks guys!

Another important thing is building up savings. In the beginning, I strived to have 6 months worth of savings, i.e. enough for all operations for 6 months with no revenue coming in. Later on, we got to Bill Gates’ philosophy of 12 months savings. Ever since he started Microsoft, Bill insisted on having enough cash in the bank to keep the company alive for 12 months with no revenue.

Once you get to 12 months of savings you’re very comfortable, because no matter the downturn, you’re probably going to survive.

This has meant we’ve never needed to fire people for financial reasons. We’ve simply never had to do it, not even during COVID (when everyone in travel was cutting a quarter or more of their workforces). We didn’t cut anybody, and as a result we were able to rebound much, much faster than everybody else.

It also helps build your company culture, because people feel safe and protected no matter what happens in the macro environment.

There are so many advantages of being based in the Netherlands! Here are some things we’ve taken advantage of that have helped us reach scale and profitability:

No other ecosystem I know of has those five. Take advantage of them!

If you ran a VC-funded company and had to shift focus to profitability due to market changes, what actions would you take?

Raising money is like being at a buffet and ordering everything, then finding not only can you not eat it all, you have to work out how you’ll pay for all the dishes you piled up!

What’s a better way to grow than like an all-you-can-eat buffet? Instead, fill your plate just a bit first. Sit down, eat, and think for two minutes. It’s a more sustainable way, it’s better for you, and you probably won’t end up blowing (or throwing) up!

But in all seriousness, when you have investors, they often become your most important stakeholders. When you don’t have investors, or by becoming profitable so you don’t have to rely on them anymore, your most important stakeholders then become your customers or your employees.

That is huge, and exactly how it should be. The way you treat them, and the way you build a culture, is everything you have in my opinion.

What happens to profitable companies when VC funding runs out?

How we survived and quickly rebounded from Covid-19 (shared in May 2020) — also a podcast on the same topic

Why often being late-funded is better than being heavily-funded (early)

Techleap announces the appointment of two new members to its leadership tea...

Techleap announces the appointment of two new members to its leadership tea...